Every time you binge your favorite Netflix show or spend hours on Instagram, you’re relying on massive data centers that power these services — and as our appetite for digital content and services grows, so does the need to build more of them across America.

These ‘digital warehouses’ keep our world running but come with a hefty energy bill. Data centers use as much as 1.5% of global electricity — enough to power a major international city.

Yet, rather than slowing growth, this rising energy demand is driving the expansion of alternative energy sources to support the expanding digital infrastructure.

Companies are exploring more sustainable energy solutions, from Microsoft’s $1.6 billion investment in reviving the Three Mile Island nuclear plant to Apple’s solar-powered data centers in Nevada.

Examining data from real estate firm JLL’s 2024 report on data centers, we calculated which U.S. regions have the most ambitious plans to expand their data center capacity as of mid-2024. Our analysis looks at how this growth can positively impact local economies and America’s energy future too.

Big Takeaways

- A typical data center construction project adds $243.5 million to the local economy, creating 1,688 construction jobs. It will then sustain 157 permanent jobs, contribute $32.5 million annually to the local economy, and generate $1.1 million in yearly tax revenue.

- Viva La Data: Data center power capacity in Las Vegas/Reno is projected to grow by 953%, increasing the region’s data center electricity needs to a level that could power about 3.1 million homes.

- A Digital Powerhouse: Known as the world’s largest data center hub, Northern Virginia will soon have a capacity requiring power equivalent to 9.1 million homes, nearly triple the number of households in the entire state.

- Desert Data: Phoenix ranks second in the U.S. in growth and is set to increase its data center capacity by 553%, requiring enough electricity to power 4.4 million homes.

While Northern Virginia will continue to dominate the data center market, more affordable regions such as Phoenix and Dallas-Fort Worth are becoming prime locations for new developments. In fact, once the epicenter of tech innovation, Silicon Valley is losing ground as costs rise and power constraints hinder further expansion.

Here’s a breakdown of the top U.S. regions by future power requirements:

- Northern Virginia: 11,077 MW

- Phoenix: 5,340 MW

- Dallas-Fort Worth: 4,396 MW

- Las Vegas/Reno: 3,812 MW

- Atlanta: 3,125 MW

Data center expansion is slowing in areas like the Pacific Northwest and Chicago due to geographic constraints and higher costs.

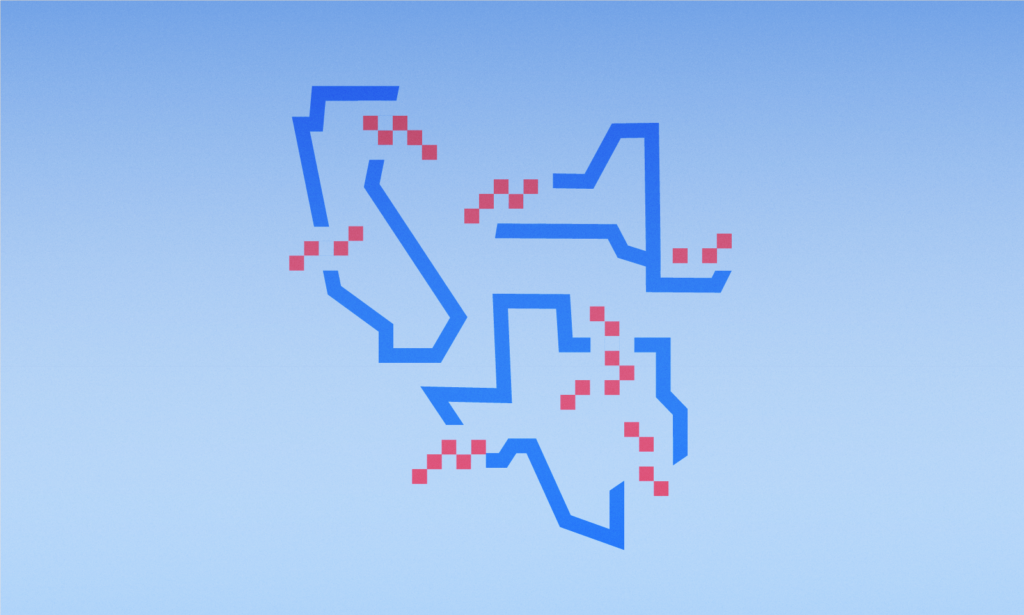

5 Fastest-Growing Data Center Hubs in America

Data center demand in the U.S. is growing exponentially. According to commercial real estate firm JLL, demand is expected to increase at a 23% compound annual growth rate through 2030.

To meet that demand, data center capacity must grow quickly.

To determine which regions are growing their data center capacity the fastest, we looked at both current and future data center capacity, including what’s currently under construction and planned. By comparing these numbers, we identified the U.S. hubs that are the fastest-growing.

Below are the top five regions expected to see the most substantial growth in their data center power capacity.

1. Las Vegas/Reno

With an anticipated capacity growth of 953%, Las Vegas and Reno's data centers will soon require 3,812 MW of energy to operate – enough to power 3.1 million homes.

Significant investments, such as Google's $400 million data center in Nevada, are driving the industry’s growth in the region. One significant factor behind data center growth in Las Vegas is the electricity rate, which is 35% lower than the national average. Nevada Energy, the largest utility company in the state, generates most of its power from renewable resources like geothermal, hydroelectric, and solar energy.

2. Salt Lake City

Data center capacity is set to grow 699.37% in Salt Lake City with potential future capacity expected to reach 1,271MW.

Salt Lake City is the heart of the Mountain West's booming data center industry, primarily due to Utah's attractive tax incentives.

The region’s affordable real estate and growing tech presence have attracted investments, helping the local economy thrive. Utah’s state government has been generous in offering tax incentives for new data center developments, attracting big companies like Meta and Google, who can expand in the state at a cheaper cost.

3. Phoenix

Phoenix is set for a 553.61% growth in data center capacity, resulting in future energy capacity of 5,340 MW—enough to power 4.4 million homes.

Where neighboring California uses a diverse but expensive mix of energy sources, including a significant reliance on imported energy, Arizona, including Phoenix, relies more on natural gas and renewable energy sources like solar. These energy sources have lower production costs than traditional power sources, which according to commercial real estate firm CBRE, contributes to why Phoenix has surpassed Silicon Valley as the largest primary market in North America for data centers.

4. Atlanta

The Atlanta region’s data center capacity is targeted to increase by 484.11%. With this growth, the region's data center's maximum energy needs will rise to 3,125 MW—enough to power about 2.6 million homes.

A new, massive investment by Microsoft is set to further power Atlanta’s data center market. The project represents a staggering $1.8 billion commitment to the region. The expansion will introduce three state-of-the-art data centers, with a combined power demand of 324 MW.

Microsoft’s project will effectively double the size of the existing data center infrastructure in metropolitan Atlanta, reinforcing the city’s growing reputation as a critical player in the global digital ecosystem.

5. Dallas-Fort Worth

Dallas-Forth Worth (DFW) data center capacity is projected to grow by 355.07%, requiring up to 4,396 MW of energy — enough to power about 3.68 million homes.

DFW also stands out for its affordability, ranking seventh among the top 20 metros in land costs for colocation data centers. For instance, land in Boston is nearly twice as expensive, and in Silicon Valley, prices are 14 times higher than in DFW.

This cost advantage and robust local business infrastructure make the DFW area a prime choice for companies seeking cost-effective colocation solutions.

#1 Data Center Hub: Northern Virginia

Northern Virginia continues to lead the U.S. data center industry, with future capacity double that of its nearest competitor, Phoenix.

Once the planned data centers are fully built and running at full capacity, they will have energy requirements equivalent to the amount of electricity needed to power 9.1 million households. That’s more than three times the number of homes in the entire state of Virginia. For further context, in 2022, New York City had around 3.28 million households, meaning Northern Virginia’s future data center energy needs could power nearly three New York Cities.

The biggest challenge for the state is finding a way to power these growing data complexes. Virginia’s power supply must nearly double in the next 15 years to meet rising demand. Dominion Energy estimates that power demand in Virginia is expected to grow by 85% over the next decade and a half.

The Hidden (Data Center) Economy Behind Your Favorite Apps

Data centers are large buildings that house tons of servers, data storage drives, and network equipment that together comprise the computing infrastructure for everything we do online. They serve as the physical backbone of the internet, the literal storage space for the digital cloud.

As we increasingly use and rely on the internet, the need for these data fortresses is growing fast. And their growth is doing more than just keeping our digital world running. In regions where data centers are rapidly expanding, it’s also bringing substantial economic benefits to local economies.

According to the U.S. Chamber of Commerce, building a data center supports job creation. About 1,688 workers are employed during construction alone, bringing in $77.7 million in wages and generating $243.5 million in local economic output.

Once a new data center is up and running, it continues to fuel long-term economic growth by supporting:

- 157 permanent jobs

- $7.8 million in wages annually

- $32.5 million added to the local economy

- $1.1 million contributions in tax revenue yearly.

Data center growth brings more than just short-term benefits; it contributes to stable, long-term employment opportunities and supports regional economic development. By creating jobs in both construction and ongoing operations, these facilities help strengthen local economies over time.

Green Energy Revival: Powering Data Center Growth

As data centers expand, the increasing power demands are pushing companies like Google, Microsoft, and Amazon to invest in renewable and carbon-neutral energy sources such as solar, wind, and hydropower. For instance, Google has set a goal to power all its data centers with carbon-free energy by 2030 to help meet its substantial energy needs.

In addition to driving investments into renewable energy solutions, the high energy demands of data center growth are also driving companies to make their data centers more energy-efficient. They use more efficient cooling systems, energy-saving servers, and even artificial intelligence to save power.

Nuclear energy is also becoming an attractive potential power source for data centers because it provides:

- 24/7 power, unlike solar or wind, which depends on the weather.

- Carbon-free energy, an important feature for companies aiming to reduce their carbon emissions.

- Lower costs, a big deal for the energy-intensive demands of data centers.

As data centers grow, big tech is increasingly becoming a major player in building out the infrastructure for modernized nuclear power in the United States. Tech giants are making massive investments in nuclear power as a way to secure reliable, clean energy for powering data centers.

Here’s a look at some of the biggest moves in this space:

- Bill Gates’ TerraPower is breaking ground on its first nuclear plant in Wyoming this year.

- Microsoft plans to power up the historic Three Mile Island nuclear plant.

- Google signed a deal with nuclear startup Kairos Power to supply its data centers with reliable, carbon-free nuclear power.

- Amazon inked an agreement with Energy Northwest to build four small modular reactors (SMRs) and has invested in X-energy to power its data centers.

According to the U.S. Department of Energy, U.S. nuclear capacity could triple from 100GW in 2024 to 300GW by 2050, potentially providing a scalable, long-term solution for the increasing energy needs of data centers.

Data center growth isn’t slowing down anytime soon

As data centers continue to expand across regions like Northern Virginia, Phoenix, and Las Vegas, their impact on local economies and energy infrastructure will be profound.

The construction and operation of these facilities generate substantial employment opportunities, contributing to regional economic development through both temporary and permanent jobs. Additionally, the growing energy demands of data centers are driving investment in new power solutions, including renewable energy sources and nuclear power. This shift in energy infrastructure not only supports the operational needs of data centers but also influences broader trends in energy production and consumption in these regions.

Over time, the ongoing growth of data centers is set to play a critical role in shaping both the economic and energy landscapes of these emerging hubs.

Methodology

We started with data collected from JLL’s 2024 report on data centers, including details on 17 of America’s top data center regions. The data available is measured not by the number of individual centers but by the total data center capacity (in MW). We extrapolated this data into two measures:

- Current Capacity: Existing data center capacity

- Future Capacity/Total Projected Capacity: Current Capacity + Capacity from projects under construction + Capacity from planned expansions

Calculating Percent Growth:

For each region we compared the current power capacity (MW) with the future capacity.

Growth Rate (%) = ((Future Capacity (MW) - Current Capacity (MW)) / Current Capacity (MW)) × 100

How We Estimated the Number of Households Powered

To better understand the future energy demands for each region’s data centers, we compared the future capacity against the typical U.S. household electricity consumption: 875 kWh per month (EIA).

Here’s how we did it:

1. Found each data center's monthly power capacity

Formula: Monthly Power Capacity (mWh) = Future Capacity (MW) × 720

Note: Note: 720 hours assumes 30 days per month × 24 hours per day.

2. Converted the monthly power capacity to kWh

Formula: Monthly Power Capacity (kWh)=Monthly Power Capacity (mWh)×1,000

Note: 1 mWh = 1,000 kWh

3. Calculated how many households the energy could power

Formula: Households Powered = Monthly Power Capacity (kWh) / 875

Note: The average U.S. household uses 875 kWh per month.

Example Calculation for Las Vegas/Reno

- Future Capacity: 3,812 MW

- Monthly Power Capacity (mWh): 3,812 × 720 = 2,744,640 mWh

- Monthly Power Capacity (kWh): 2,744,640 × 1,000 = 2,744,640,000 kWh

- Households Powered: 2,744,640,000 ÷ 875 = 3,136,731 households

So, the future power capacity of Las Vegas/Reno’s data centers could power about 3.1 million households per month.

Full dataset can be found here.